Crypto vs Gold: FAQs on the Best Inflation Hedge During Crises in Vietnam

Crypto vs Gold: FAQs on the Best Inflation Hedge During Crises in Vietnam

In Vietnam, where financial and political uncertainties periodically resurface, many people are asking: crypto vs gold — which asset offers better protection? Below, we explore the most frequently asked questions about how these assets perform as inflation hedges and safe havens during crises in Vietnam.

What makes gold a trusted crisis hedge in Vietnam?

Gold holds a unique position in Vietnamese culture. It’s more than an investment — it’s a traditional store of wealth passed down through generations.

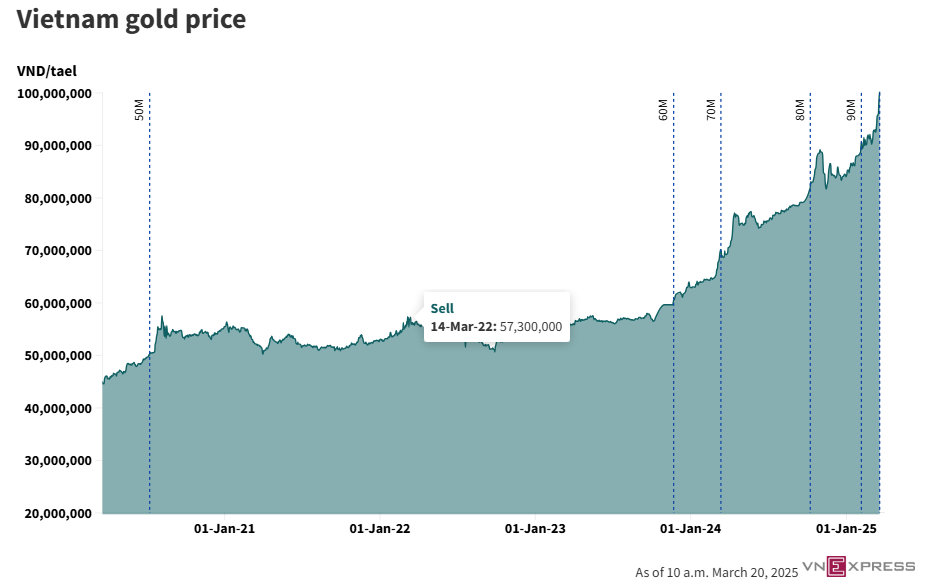

During times of inflation, currency depreciation, or political instability, gold prices in Vietnam often rise, and local gold shops see a surge in demand.

People trust gold because it is tangible, easy to understand, and historically proven as a safe haven. The habit of holding physical gold is deeply rooted in Vietnamese society, making it one of the country’s default assets in times of uncertainty.

Source by: AInvest

How do gold prices in Vietnam react to financial and political crises?

Gold prices in Vietnam typically increase when inflation spikes or when the Vietnamese dong weakens.

Local reports often describe long queues at gold shops during such periods. The pattern is consistent: when people feel uncertain about the economy, they turn to gold.

However, gold’s performance is generally steady rather than spectacular. It offers protection, but not the rapid growth some risk-tolerant investors may seek.

Is crypto a reliable inflation hedge in Vietnam?

Crypto investment in Vietnam has gained strong momentum in recent years, especially among younger generations. Some Vietnamese see crypto as a modern hedge against inflation and restrictive financial policies.

Unlike gold, cryptocurrencies like Bitcoin can move quickly, offering potential for fast gains and easy cross-border transfers. This flexibility appeals to people concerned about capital controls or limitations on foreign currency access.

Still, crypto’s high volatility is a double-edged sword. Prices can swing dramatically within hours, introducing substantial risk during already uncertain times.

How does the Vietnamese government view crypto?

Vietnam’s regulatory approach to crypto is still developing. Authorities have expressed concerns about fraud, money laundering, and speculative bubbles.

While crypto trading is not fully banned, it’s not officially recognized as a legal payment method either. This regulatory grey area means that during times of political or financial stress, accessibility to crypto may face sudden restrictions.

Investors considering crypto as a crisis hedge should remain aware of these potential regulatory shifts in Vietnam.

Source by: VEXPRESS

In a financial crisis, is gold or crypto more practical in Vietnam?

Gold remains more practical for most Vietnamese households during a crisis. It is widely accepted, easy to convert into cash locally, and carries a deep cultural trust.

Crypto, on the other hand, offers speed, mobility, and the ability to bypass certain financial barriers. For example, during currency devaluation scares or restrictive banking measures, some Vietnamese have turned to crypto as an alternative route.

However, crypto’s sharp price fluctuations can add stress during an already difficult economic situation.

Can crypto and gold work together as part of a crisis strategy?

Yes, many investors in Vietnam are starting to mix both assets. Gold provides stability and cultural comfort, while crypto adds potential for faster movement and higher returns — albeit with more risk.

Some see this blended approach as a balanced way to hedge against Vietnam’s complex financial risks.

Conclusion: Crypto vs Gold — Which is Better in a Vietnamese Crisis?

The question of crypto vs gold is not easily settled. In Vietnam, gold remains a trusted, stable inflation hedge and safe haven asset, especially during financial and political crises. Crypto, meanwhile, offers new opportunities and flexibility, but also brings regulatory and volatility challenges.

For many Vietnamese investors, the smart approach may lie in diversification — holding both gold and crypto to spread risk and increase options when navigating future economic uncertainties.